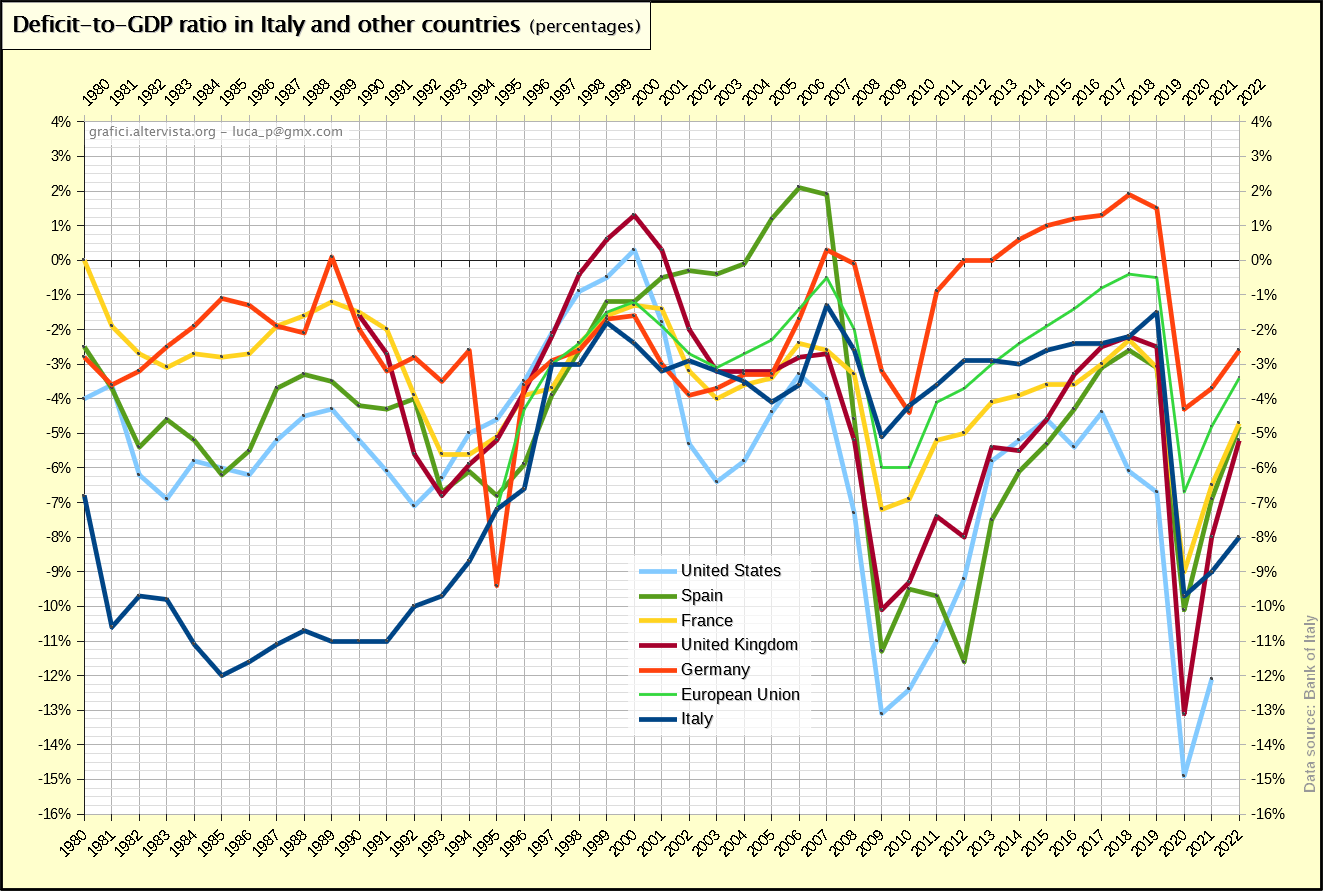

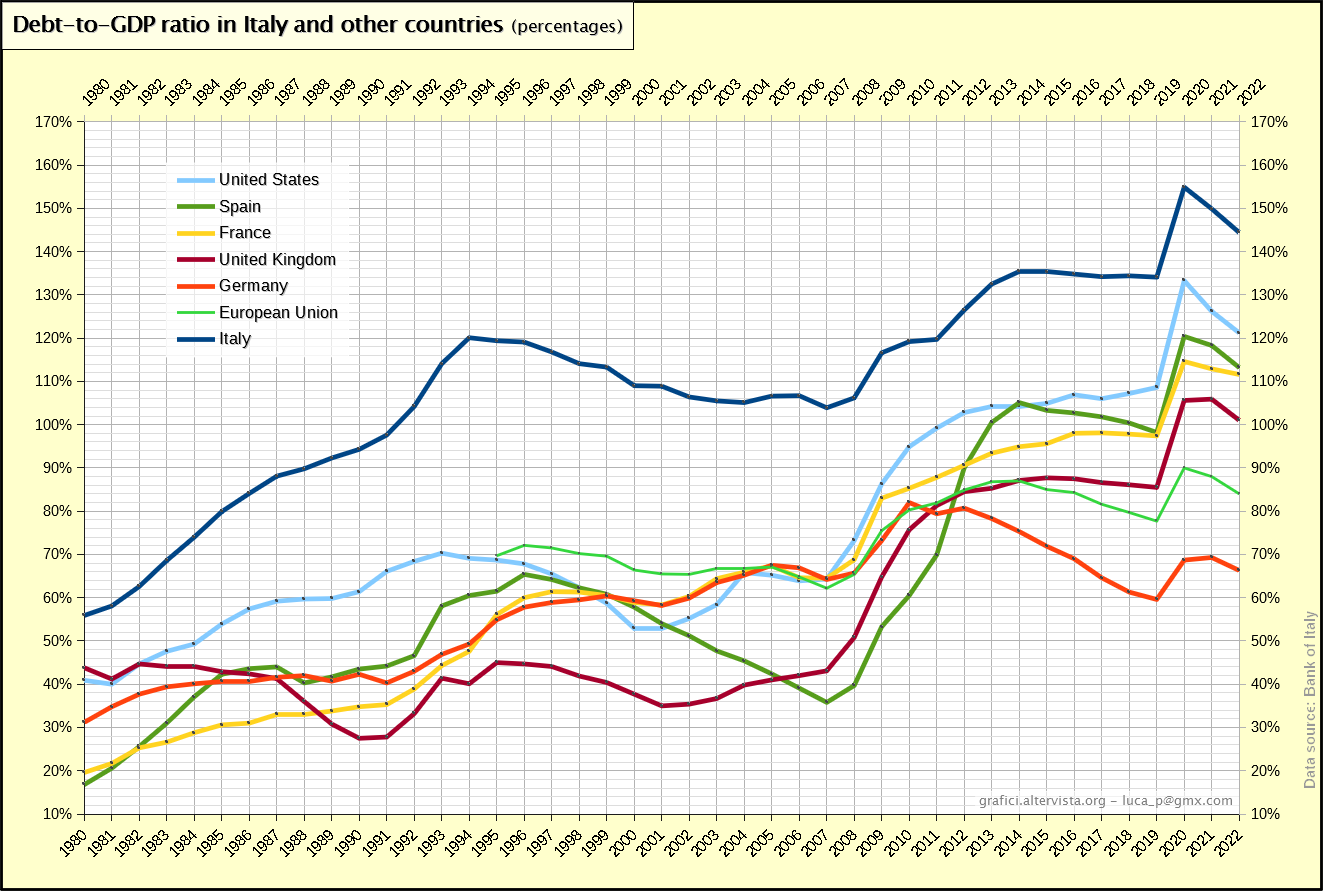

Let’s look at the long-term trend of these two indicators of public accounts for some countries.

(updated with 2022 data)

In 2022 deficit-to-GDP ratios of the various countries represented in the chart are: Italy, -8.0%; Germany, -2.6%; France, -4.7%; Spain, -4.8%; United Kingdom, -5.2%; European Union, -3.4%. The U.S. figure is not available at this time.

In 2022 deficit-to-GDP ratios of the various countries represented in the chart are: Italy, -8.0%; Germany, -2.6%; France, -4.7%; Spain, -4.8%; United Kingdom, -5.2%; European Union, -3.4%. The U.S. figure is not available at this time.

In 2021 debt-to-GDP ratios are: Italy, 144.4%; Germany, 66.3%; France, 111.6%; Spain, 113.2%; United Kingdom, 101.0%; United States, 121.2%; European Union, 84.0%.

In 2021 debt-to-GDP ratios are: Italy, 144.4%; Germany, 66.3%; France, 111.6%; Spain, 113.2%; United Kingdom, 101.0%; United States, 121.2%; European Union, 84.0%.

Sources

Data are taken from the statistical database of the Bank of Italy section “Topics; Public Finance Statistic in the European Union” by selecting the items “Net borrowing/lending” and “Gross public debt”. In addition to European countries, the data from the United States is also reported.